Understanding The Cost of Long Term Healthcare

As millions of Boomers head into retirement saving money and paying down debt are obvious concerns, but what is really interesting is that the concern about the cost of healthcare in retirement. According to a Nationwide Retirement Institute survey that nearly half of future retirees surveyed can't or won't be able to estimate how much health care costs will be in retirement and those that did the estimate guessed very low.

To better understand why they should prepare to protect their wealth, their loved ones, and their financial independence, it's a good idea to look at Home Health Care, Adult Day Care, Assisted Living, or Nursing Home Care. The cost of this care will vary based on a variety of factors, including location, the extent of care, etc.

For Sponsor Code Use - LTC

Top 10 reasons you should consider long term care planning

A Brief Guide To Long-Term Care Planning

Understanding The Impact of Long Term Care

- Financial Impact

With Americans living longer than ever, there is simply a greater likelihood they will experience a LTC need and the costs associated with care are significant. While it can take decades to accumulate the savings and assets needed to retire comfortably, just a few years of LTC expenses can threaten a secure retirement lifestyle.

- Emotional & Physical Impact

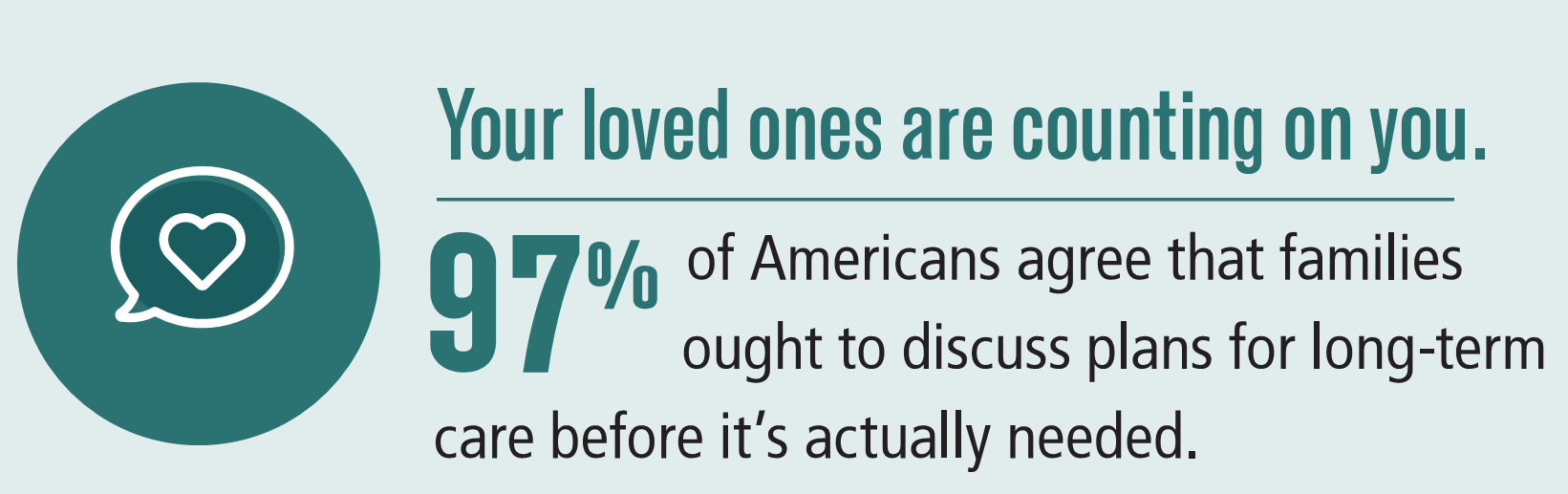

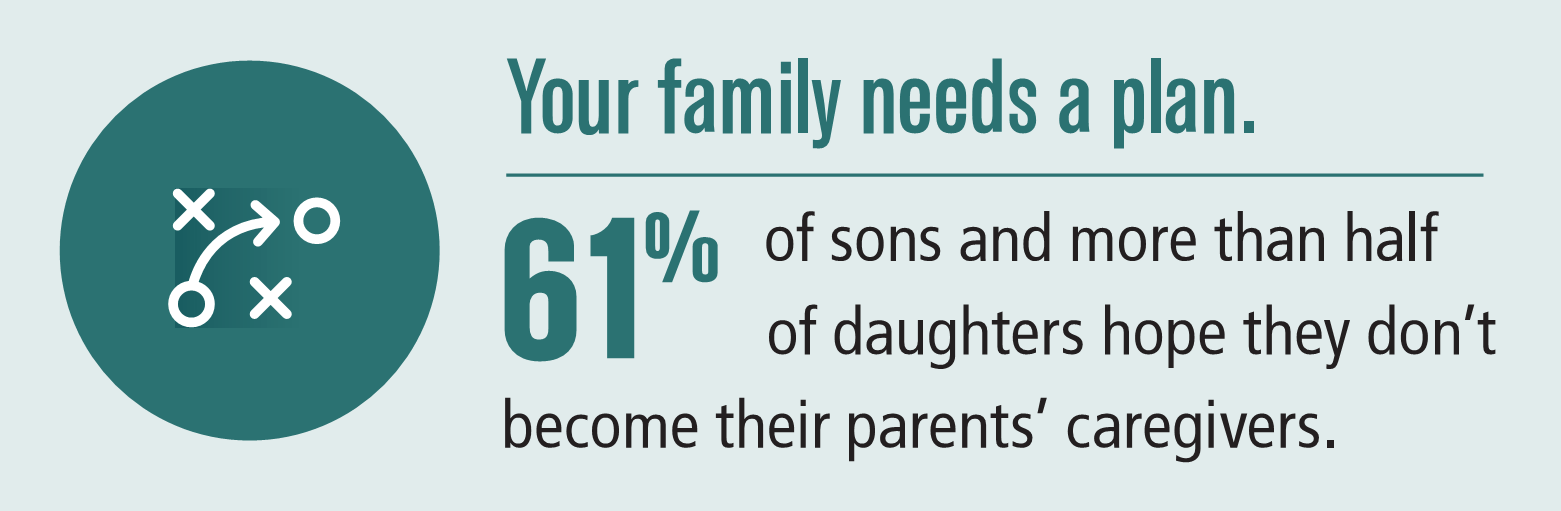

While providing care to loved ones is an act of compassion, placing burdens on spouses, children and other family members can create a significant strain and emotional toll. Avoiding this scenario and making sure their family doesn't have to shoulder this responsibility is the primary reason to plan for LTC

- Consequences of Not Having a Plan

Waiting to address LTC Planning – especially until the time care is needed – can significantly impact financial security, quality of life, and the ability to maintain one's independence. By incorporating a LTC plan early will help protect assets, reduce the burden which might fall on family members, and allow care to be provided in the setting you most prefer.

For Sponsor Code Use - LTC

The Planning Process

The Planning Process

When beginning that process there are many factors to consider.

(1) determining the "Cost of Care" based on where you plan to retire,

(2) potential setting desired to receive care

(3) how much of those expenses you are willing or able to pay out of your own pocket?

- Waiting Too Long to Plan

An important reason to address LTC Planning sooner rather than later is that your planning options will be based on age and health, so the younger you are, the less expensive a plan might cost.

- Who Should the Plan Cover?

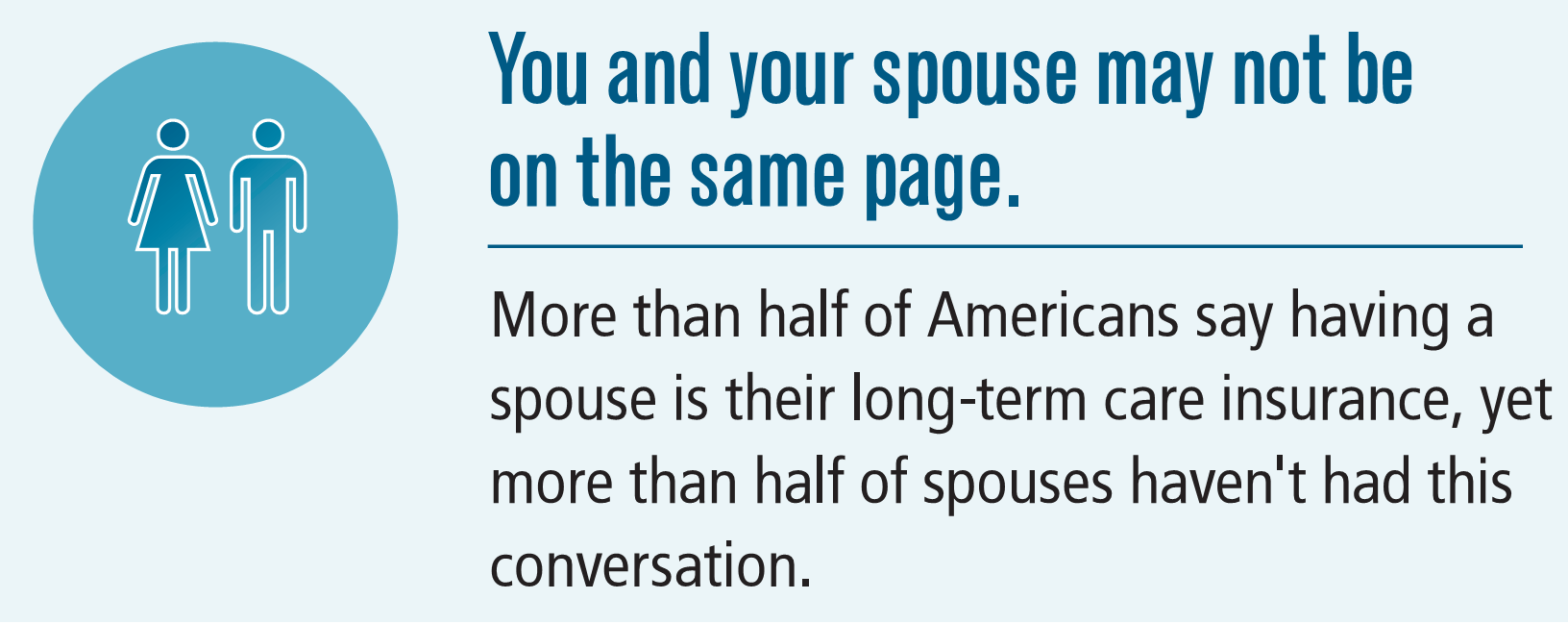

LTC decreases the potential risk to either spouse meant for couples.

Singles making sure that coverage is there when they need it.

- How Much Should Be Covered?

Without a plan, you are “self-funding” the entire risk of paying for care. Too many people overestimate their ability to pay for future care or convince themselves that they’ll never need care but that doesn't change the actual risk of needing and paying for care. Implementing a LTC plan makes it possible to transfer that risk - one of the biggest financial threats facing Americans in retirement - and can be a proactive way to protect both assets and loved ones.

The Modern Estate Plan

Protection from Estate Erosion instead of the Estate Tax

Since the creation of the Federal Estate Tax in 1916, American families have been doing whatever possible to mitigate or shield their estates from erosion resulting from those taxes. The Federal Estate Tax itself has varied in its severity, with the top tax rate reaching as high as 77% in 1941. Today, however, with an exemption of more than $11 million dollars, or more than $22 million for a couple, the Estate Tax will only affect the wealthiest of Americans.

With respect to Estate Planning, perhaps it is time to recognize that Healthcare In Retirement and Long-Term Care pose a greater risk of estate erosion than any estate tax; as this pseudo-tax can and will reach into the pockets of even those with the most modest of estates. As such, addressing Healthcare In Retirement and Long-Term Care planning should become the focus of “The Modern Estate Plan”.

Estate Erosion Due To Healthcare Expenses

With an aging population, more Americans than ever are seeing and feeling the impact of healthcare and Long-Term Care expenses - not covered by Medicare - for their parents. Most of us are know of friends or loved ones diagnosed with Alzheimer’s, dementia or some other chronic condition, who are being forced to spend their hard-earned savings to pay for care and/or nursing home expenses. However, most of your clients are concerned about modest or basic healthcare expenses, which Fidelity estimates will cost the typical couple an average of $275,000 throughout retirement.

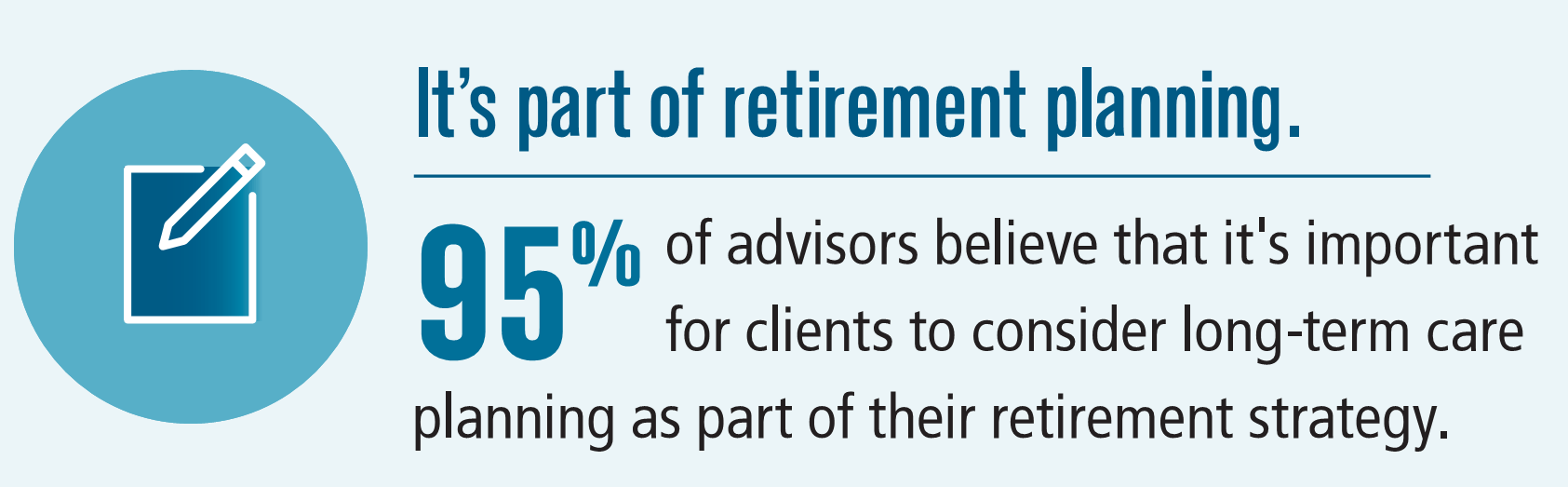

It's no wonder then, that Boomers “rank health care expenses as their top financial worry in retirement”, according to Merrill Lynch and AgeWave Consulting. Unfortunately, far too many advisors are not discussing Healthcare In Retirement or Long-Term Care....Clients are either forced to bring it up or they are often dismissed by their advisors who assure them “self-funding” the risk with their assets or investments is a good "plan". Perhaps there's a better approach?

The Modern Estate Plan At Work

We consistently encourage advisors to engage clients to discuss their concerns and stress the reality that there is likely a better strategy. During those discussions, a simple, pointed question should be asked:

”If you need Long-Term Care, or care not covered by Medicare,

which of your assets would you tap first to pay for that care?”

The answer will indicate how efficiently and effectively fund a plan, and if there is the potential to reposition assets to create a plan. Not only can the plan help protect your clients from estate erosion due to the cost of healthcare costs, quite often simple repositioning of assets will create a substantial plan with ZERO out-of-pocket cost. Should the plan never be used to pay for care, a death benefit would be paid to your clients' heirs.

The estate tax may not affect you, but a “Modern Estate Plan” could help mitigate

the risk of estate erosion due to Healthcare In Retirement and Long-Term Care